38+ home mortgage interest deduction 2021

The terms of the loan are the same as for other 20-year loans offered in your area. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

The Home Mortgage Interest Deduction Lendingtree

Married filing jointly or qualifying widow er.

. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web For 2021 tax returns the government has raised the standard deduction to. Web 5 hours agoOn Jan.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. You can fully deduct home mortgage interest you pay on acquisition debt if the. Web But what turbotax did was calculate the average for the first house as 422k02 211k.

From the left sections select Excess Mortgage Interest. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. The current tax law is scheduled to sunset in 2026.

Homeowners who bought houses before December 16. Average balance of home acquisition debt incurred after December 15 2017. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web To enter mortgage interest in the TaxAct program go to our Form 1098 - Entering in Program FAQ. Web Today I go over one of the biggest tax deductions for individuals and home owners. Another itemized deduction is the SALT deduction which.

Web For federal purposes the itemized deduction rules for home mortgage and home equity interest you paid in 2021 have changed from what was allowed as a. Web Trumps Tax Cuts and Jobs Act of 2017 lowered the Mortgage interest deduction limit from 1000000 to 750000. The cost of the loan.

Per IRS Publication 936 Home Mortgage Interest Deduction page 2. Web Up to 96 cash back Used to buy build or improve your main or second home and. You paid 4800 in.

In the 2021 tax year the IRS temporarily allowed individuals to deduct 300 per person those married filing jointly can. 11 2023 the IRS announced that California storm victims now have until May 15 2023 to file various federal individual and business tax returns and make. This alone will save you thousands in taxes.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web IRS Publication 936.

The input within the program is. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. This portion of the worksheet only appears if you entered a 1 in the 1debt incurred.

Web The traditional monthly mortgage payment calculation includes. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web Go to Screen 25 Itemized Deductions.

For taxpayers who use. Single or married filing separately 12550. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

Enter information for up to 4 loans. If you have a. Web Unfortunately as of April 2022 the answer is no.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Then added the entire amount of the 2nd house mortgage 11m to. The amount of money you borrowed.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Secured by that home.

Mortgage Interest Deduction

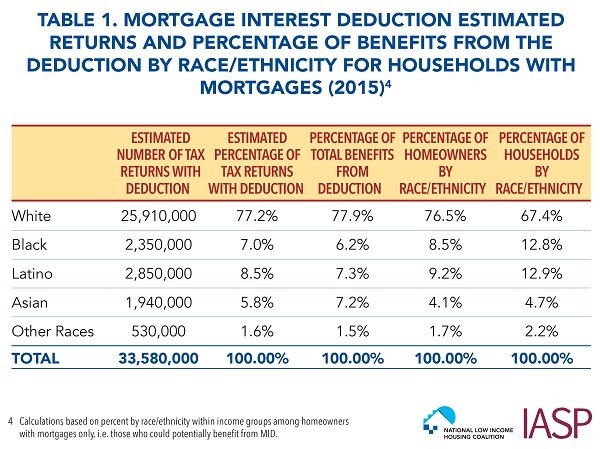

Race And Housing Series Mortgage Interest Deduction

Maximum Mortgage Tax Deduction Benefit Depends On Income

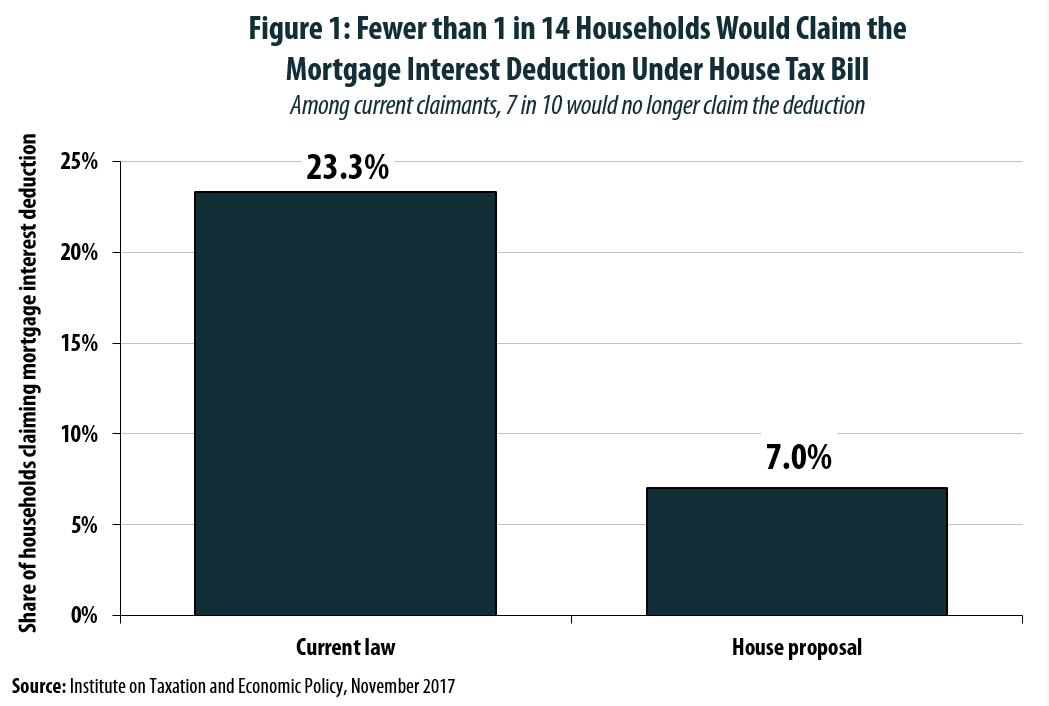

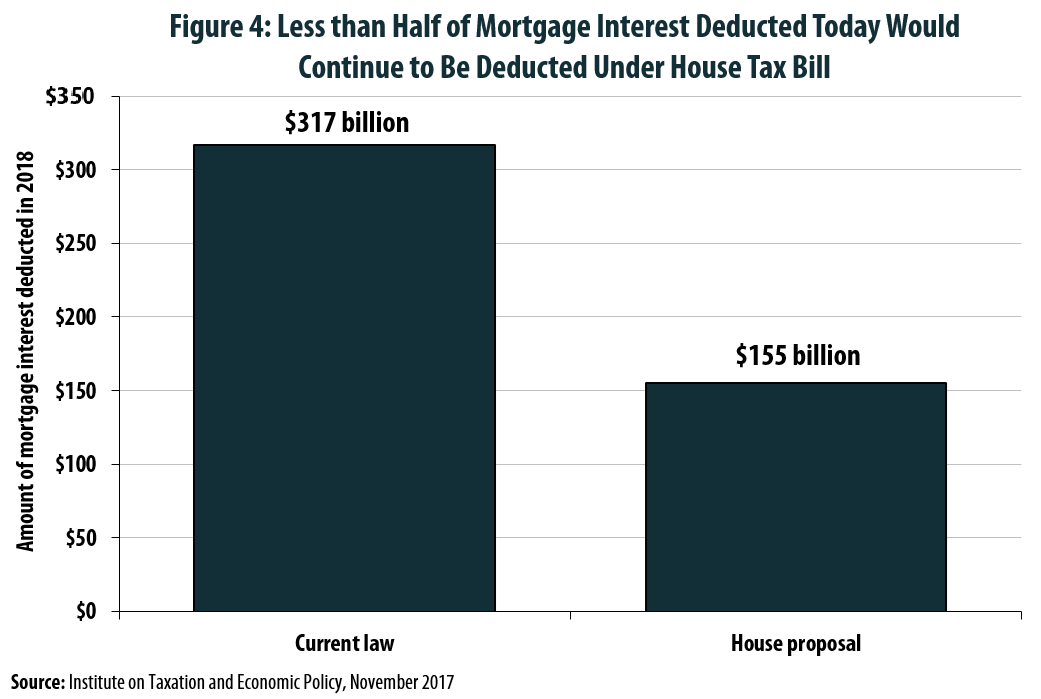

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

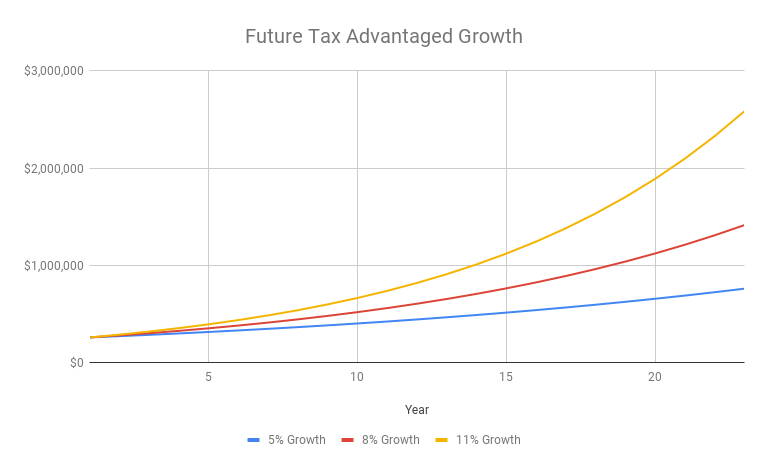

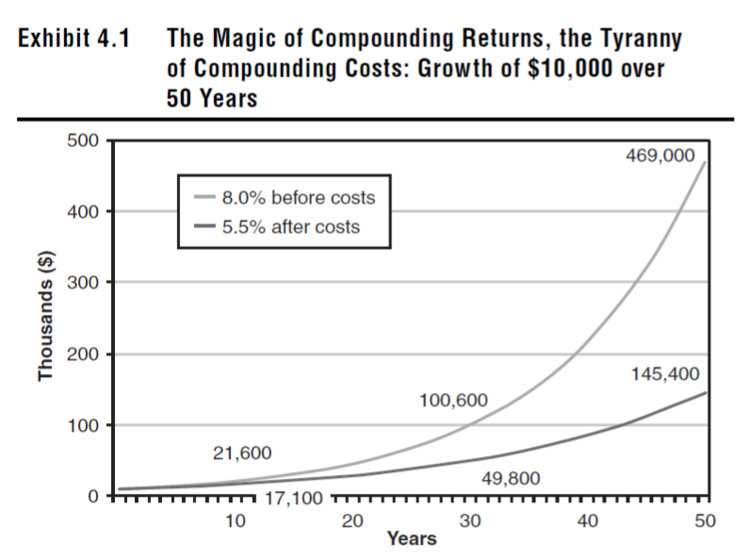

Why You Should Max Out Your 401 K In Your 30s

Mortgage Interest Deduction Bankrate

Maximum Mortgage Tax Deduction Benefit Depends On Income

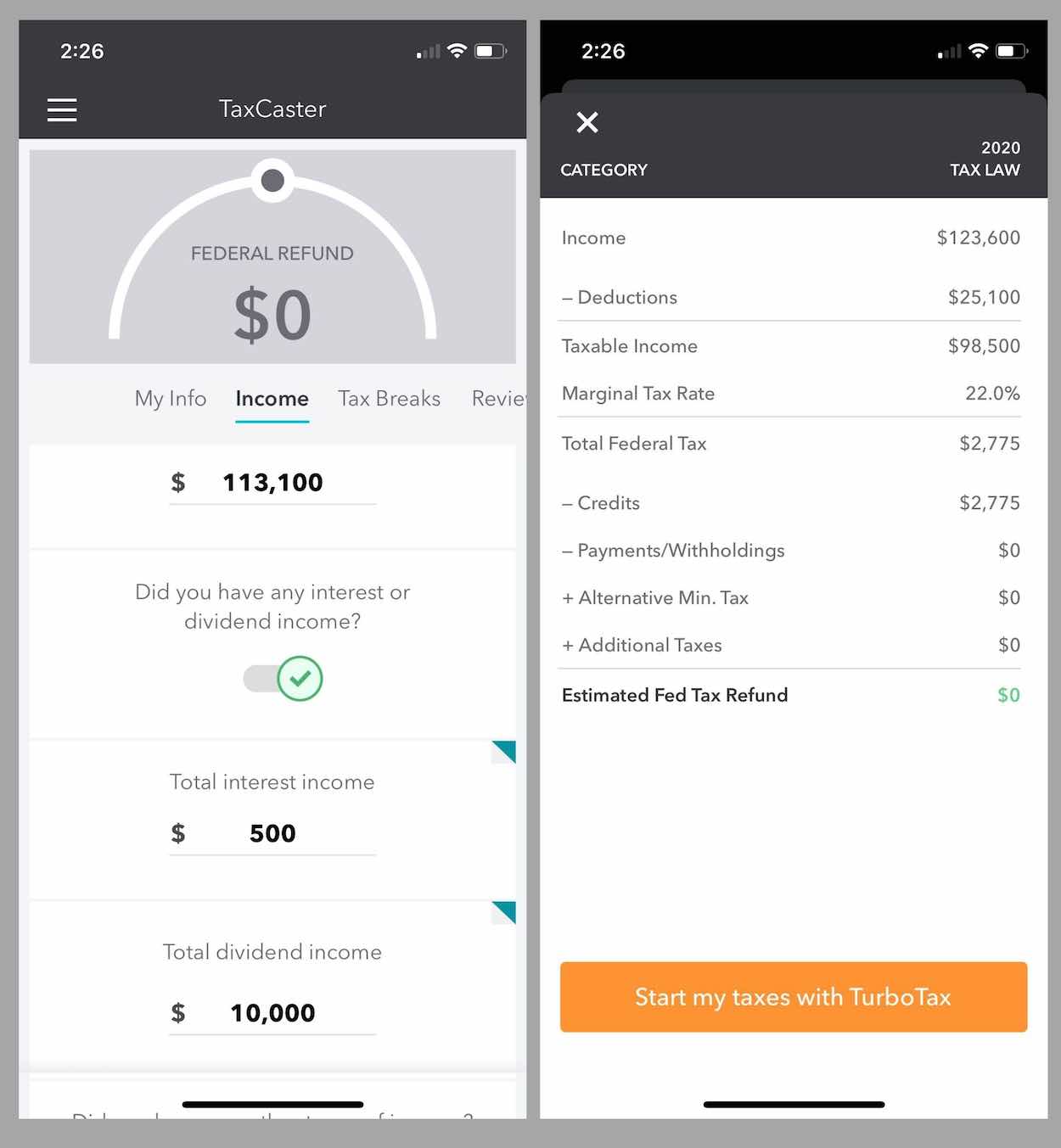

2021 Tax Planning Avoiding Capital Gains Tax In Retirement With Taxcaster

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Delta Optimist February 2 2023 By Delta Optimist Issuu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction How It Calculate Tax Savings

2021 Tax Planning Avoiding Capital Gains Tax In Retirement With Taxcaster

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

What Are The Pros And Cons Of A Conventional Loan Quora

Mortgage Interest Deduction What You Need To Know Mortgage Professional